taxing unrealized gains at death

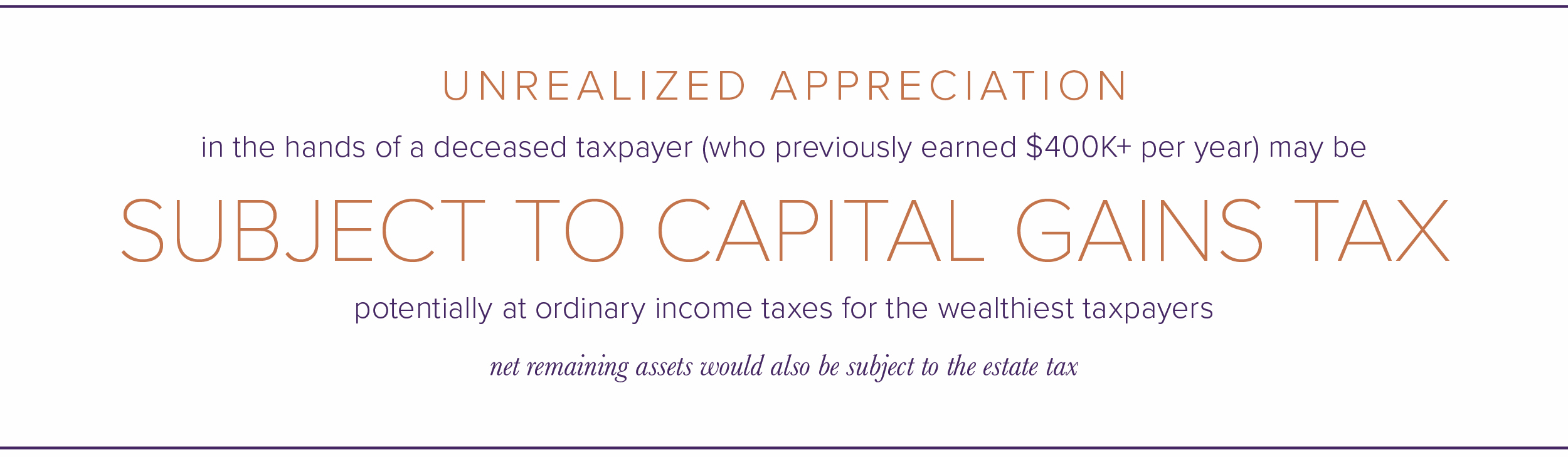

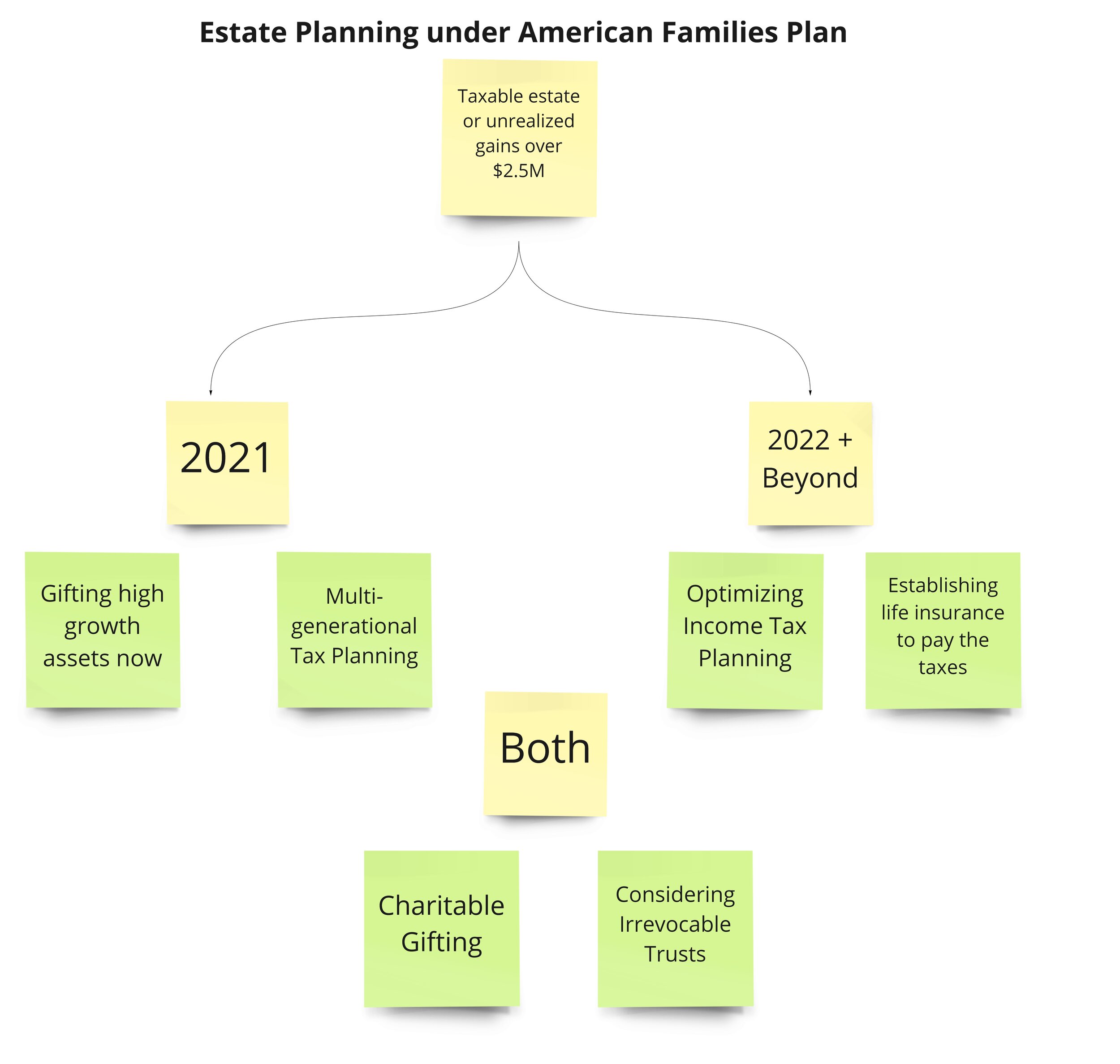

As part of the tax proposals in President Bidens American Families Plan AFP unrealized capital gains over 1 million would be taxed at death. First a capital gains tax on unrealized appreciation may be imposed whenever property is transferred at death.

Taxing Unrealized Appreciation On Lifetime Transfers And At Death Carter Ledyard Milburn Llp

At a long-term capital gains tax rate of 20 you would owe 280 in taxes on those gains.

. On May 12 2021 at a. They recommend a simpler more effective approach. Payroll Taxes Tax Expenditures Credits and Deductions Tax Compliance and Complexity Excise and Consumption Taxes Capital Gains and Dividends Taxes Estate and Gift Taxes Business.

Introduced as legislation would tax capital gains at death with an exemption for the first 1 million of gain. More than fifty years ago two leading tax experts described the failure to tax gains of property transferred at death as the most serious defect in our federal tax system. When the House Ways and Means Committee produced its components of the Build Back Better Act it omitted a proposal to tax unrealized capital gains at the time of a.

More than fifty years ago two leading tax experts described the failure to tax gains of property transferred at death as the most serious defect in our federal tax system To fix. More than fifty years ago two leading tax experts described the failure to tax gains of property transferred at death as the most serious defect in our federal tax system To fix this. Taxing gains at death would reduce the incentive for older investors to avoid taxes by holding on to assets until death even if those assets are unproductive.

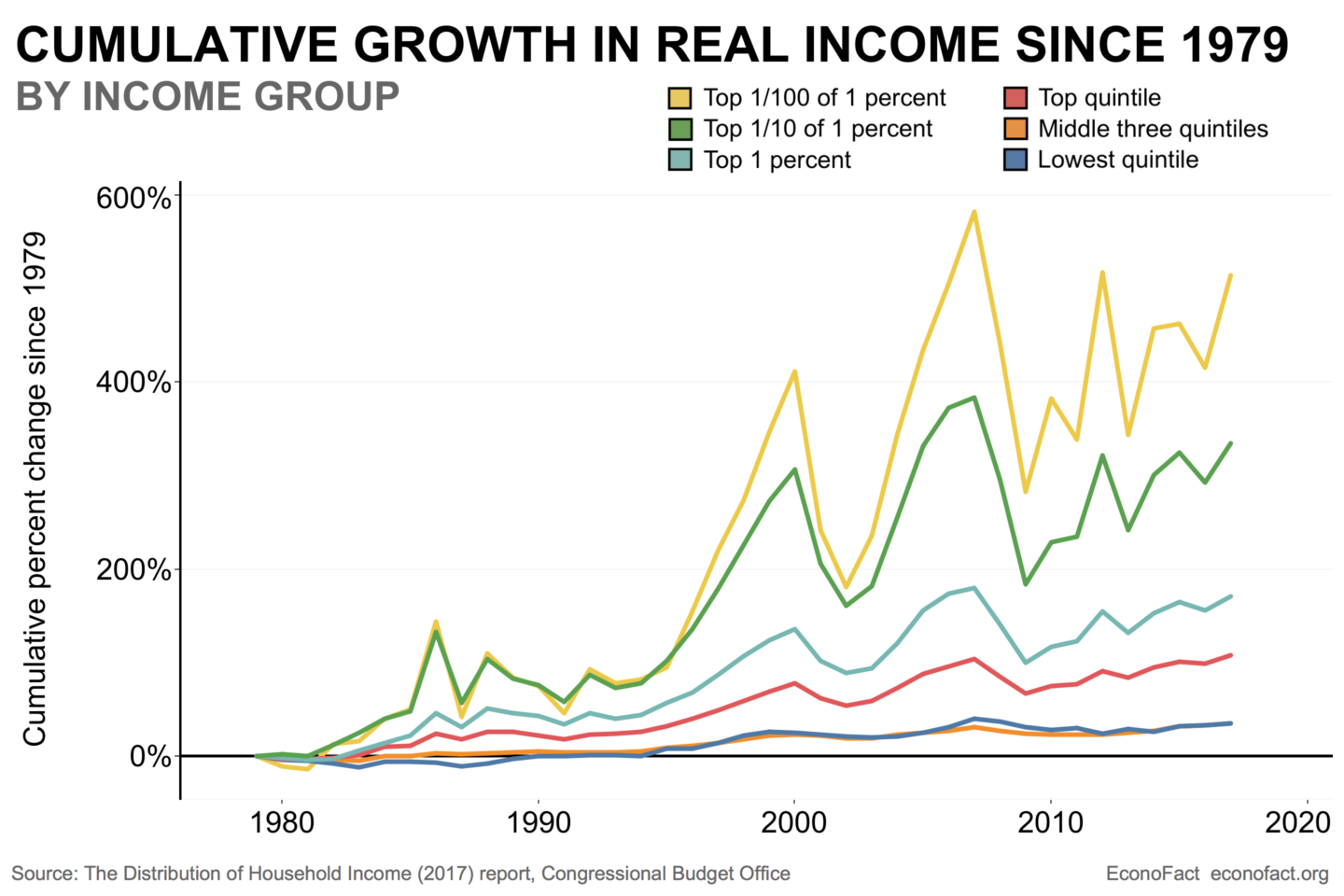

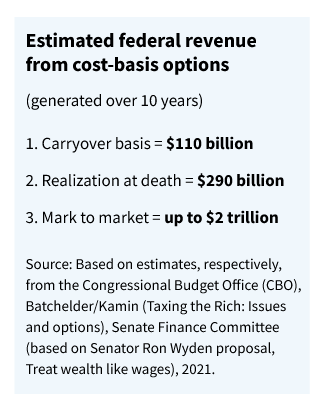

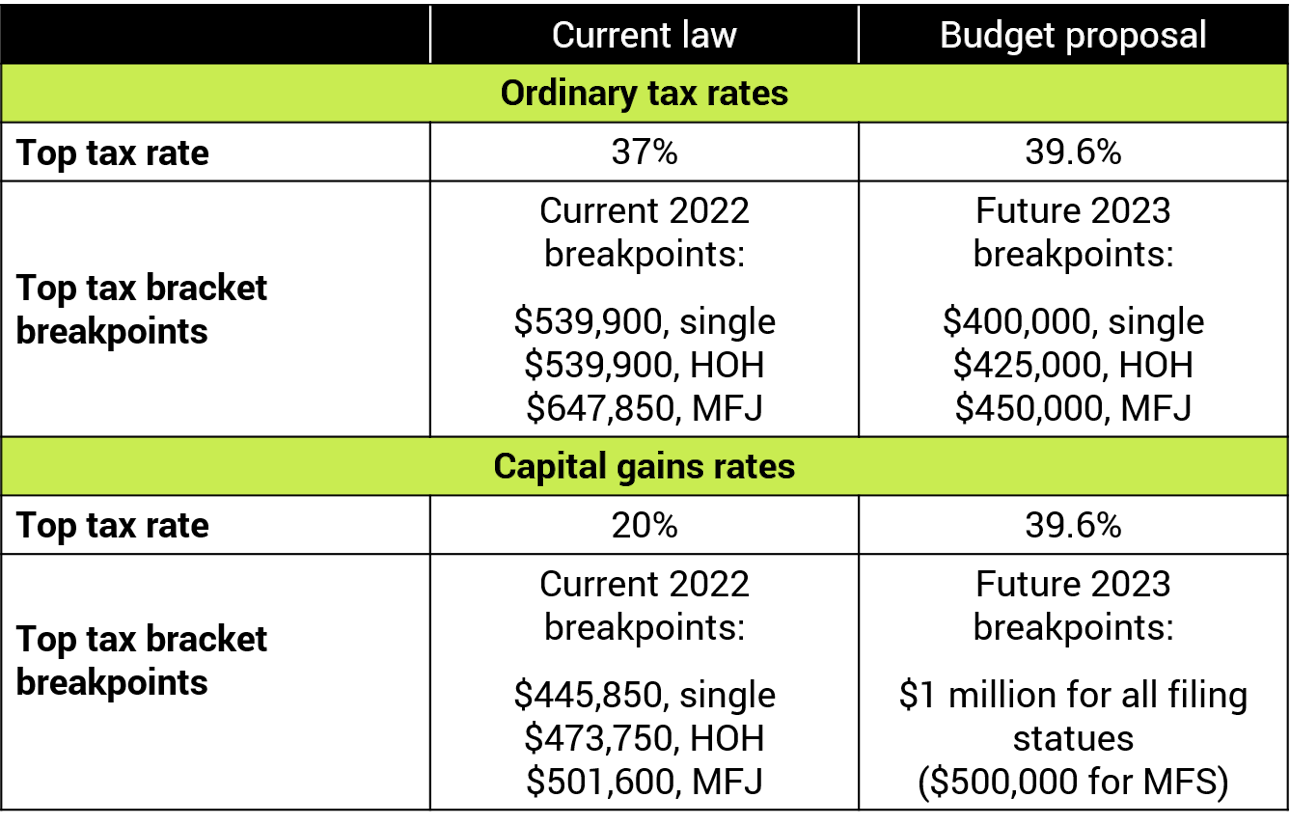

Tax unrealized gains of the wealthy at a higher rate at death than if assets are sold or given as gifts during life. There are two proposals for taxing unrealized gains at death. If these households realize 6 trillion of their 75 trillion of that gain during their lifetimes and the remaining 15 trillion at death our proposal would raise almost 2 trillion.

The effective rate could be as high as 61 when including the estate tax and taxing unrealized capital gains at death under President Bidens tax plan said Garrett Watson. Without taxing unrealized gains at death the revenue-maximizing capital gains tax rate is about 30 percent in the long run and about 20 percent in the short run. Several bills in the 116th CongressHR.

However this policy would. In that situation the assets. An article by Harry L.

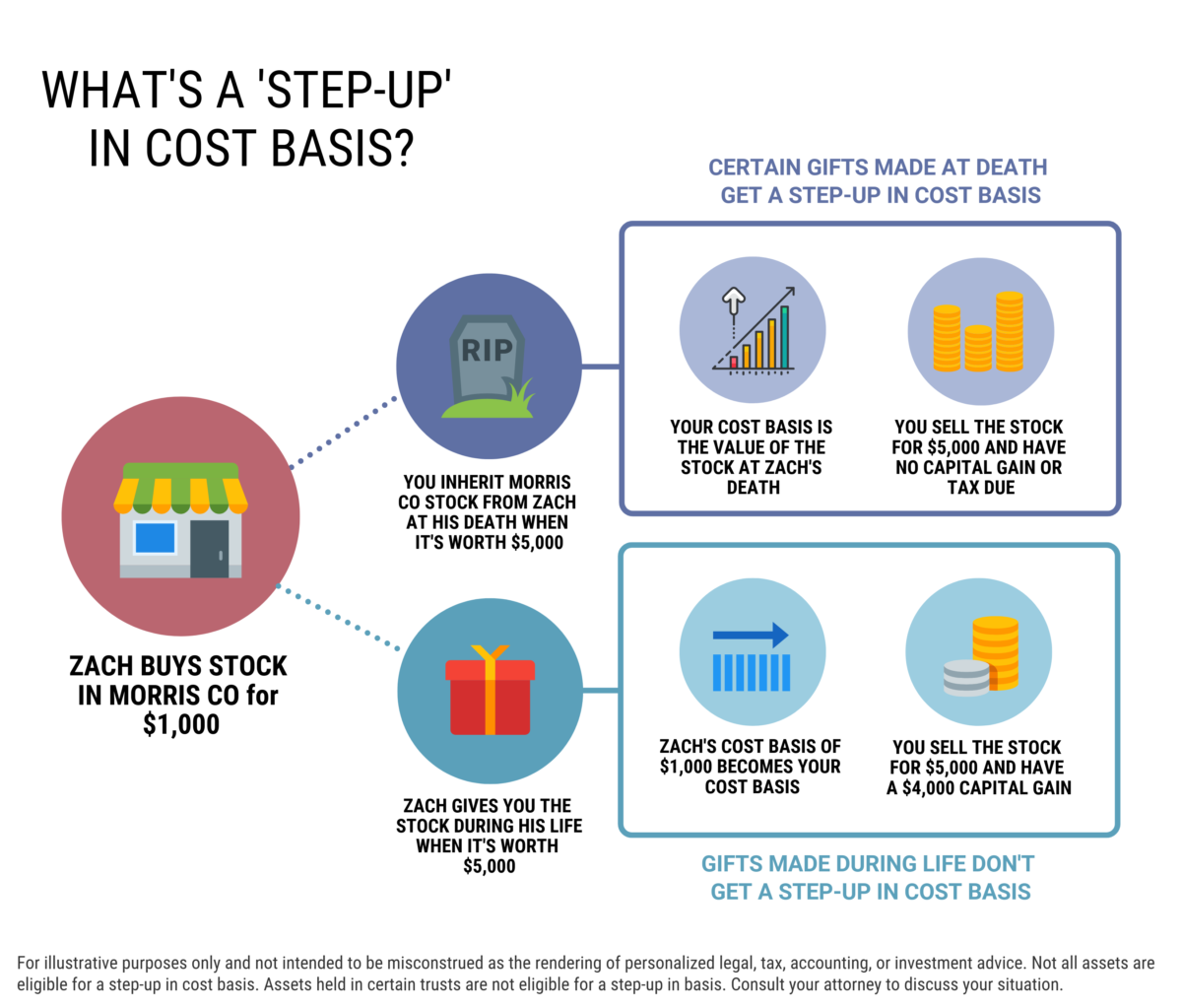

Taxing unrealized gains as they accruewhich Congressional Democrats have said is on the table for Americas billionairesor removing the tax code provision allowing heirs. Gutman captioned Taxing Gains at Death was published in the January 11 2021 issue of Tax Notes Federal the Gutman Article. Taxpayers may also hold onto assets with unrealized capital gains and pass the underlying assets and associated gains to an inheritor at death.

The only way to avoid paying taxes on the unrealized gains is to hold on to the investment indefinitely unless you die in which case the basis for the assets in your estate is. If you decide to sell youd now have 14 in realized capital gains.

Death Is No Escape From Taxes Wsj

Manchin Pans Biden S Proposed Tax On Unrealized Gains Of Wealthy Bloomberg

Three Options To Change Stepped Up Cost Basis Rules

Biden S New Death Tax Hits The Middle Class While Excluding Certain Wealthy Investors

What Is A Step Up In Basis Cost Basis Of Inherited Assets

Democrats Are After Your Money With Wealth Taxes Even A Tax On Unrealized Gains Mish Talk Global Economic Trend Analysis

What To Know About President Joe Biden S New Death Tax Plan Youtube

The Hidden Surprise In The Biden Green Book Tax Proposal Stableford

Biden Estate Tax 61 Percent Tax On Wealth Tax Foundation

Senate Dems Propose Capital Gains Tax At Death With 1 Million Exemption

Nmhc House Republicans Back Nmhc Supported Opposition To The Taxation Of Unrealized Capital Gains At Death

Senate Democrats Push For Capital Gains Tax At Death With 1 Million Exemption Wsj

Trump S Tax Plan A New Death Tax For The Middle Class The Hill

What The Wyden Proposed Tax On Unrealized Capital Gains May Mean For You

President Biden Proposes Tax Changes In Fy 2023 Budget Baker Tilly

Biden S Plan Will Stop Billionaires From Avoiding Taxes Fortune