free crypto tax calculator australia

Only capital gains you make from disposing of personal use assets acquired for less than 10000 are disregarded for capital gains tax purposes. Is there a free trial I can try.

Crypto Tax In Australia The Definitive 2021 2022 Guide

With it cryptocurrency investors can manage their portfolio generate profit-loss statements file.

. For more videos like this view the Playlist on our Channe. Thats why it is a leading tax generator for retail investors. Youll only start to pay Income Tax when you hit 18200 in total income per year.

Not only can we handle 400 exchanges and wallets but we also work with all non-exchange activity such as onchain transactions like Airdrops Staking Mining ICOs and other DeFi activity. The rate you pay on crypto taxes depends on your taxable income level and how long you have held the crypto. Crypto Tax in Australia - The Definitive 20212022 Guide.

Or Sign In with Email. For the purpose of estimating Janes CGT tax on her crypto asset alone we then apply this 325 tax rate to the 5000 capital gain included in Janes assessable income. Depends on the cryptocurrency first withdrawal per month is free BTC APY.

Zenledger is the fastest and friendliest tax software for cryptocurrency investors and accountants. Youll then pay 19 tax on the next 26799 of income and finally 325 tax on the final 5000 of income - or roughly 6717 in total. Youre viewed as a crypto trader by the ATO as its your main source of annual income.

Our Australian crypto tax calculator is the perfect tool for anyone to calculate their crypto tax. Create your free account now. Simply import your cryptocurrency data in form of a CSV file and calculate the capital gain taxes in Australia instantly.

It takes less than a minute to sign up. Ad Find the Next Crypto Gem on KuCoin1 Out of 4 Crypto Holders Worldwide Is with KuCoin. 533 less than 01 BTC ETH APY.

50 Capital Gains Tax discount. 941 less than 100000 USDT Hodlnaut is based in Singapore and was founded back in 2019. If your crypto tax situation ever gets more complex feel free to try us out at cryptotaxcalculatorio were an Aussie-made crypto tax solution.

You made 50000 throughout the 2021 - 2022 financial year. View your taxes free. Sign In with Google.

0325 5000 1625. Hodlnaut - Best Crypto Interest Account Overall. Canada was its first supported jurisdiction followed by the United States and now Australia with plans to expand to other markets.

Although the popular exchange and payment platform. You can use our software to categorize all of your transactions and will only need to proceed to payment once you want to view your tax report. Your cryptocurrency tax rate on federal taxes will be the same as your capital gains tax rate.

Your first 18200 of income is tax free. Canada was its first supported jurisdiction followed by the United States and now Australia with plans to expand to other markets. As a refresher short-term capital gains had a rate of 10 to 37 in 2021 while long-term capital gains had a rate of 0 to 20.

Although the popular exchange and payment platform didnt reveal which jurisdiction is next they will likely focus on where the majority of. Use our free cryptocurrency tax calculator below to estimate how much CGT Capital Gains Tax you need to pay on any cryptocurrency sales you made this financial year. This calculator only provides an indicative estimate based on data you have input and the tax brackets and rates found on.

The tax rate on this particular bracket is 325. Janes estimated capital gains tax on her crypto asset sale is 1625. Up to 500 USDT in bonuses for new users Trade Anytime Anywhere.

Disposing of cryptocurrency purchased with fiat currency a currency established by a countrys government regulation or law Tim purchased 400 USD Tether USDT for A800. If you hold your cryptocurrency for more than a year before selling or trading it you may be entitled to a 50 CGT discount. Calculate your Crypto Taxes in Minutes Supports 300 exchanges ᐉ Coinbase Coinspot Coinjar Compliant with Aus.

Bitcoin Price Prediction Today Usd Authentic For 2025

30 Off Crypto Tax Calculator 1 Year Subscription Rookie 29 40 Hobbyist 76 20 Investor 149 40 Trader Compare Cards Credit Card Benefits Student Rewards

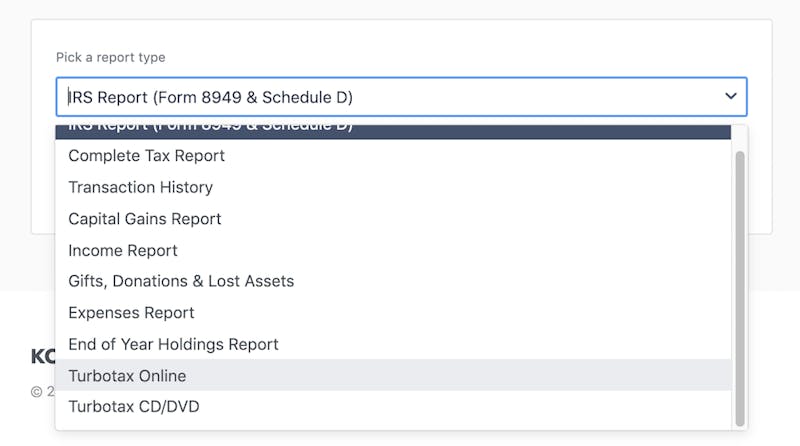

Free Crypto Tax Calculator How To Calculate Cryptocurrency Taxes Zenledger

Your Ultimate Australia Crypto Tax Guide 2022 Koinly

Btc To Aud Price Converter Sell Bitcoin For Australian Dollars Bitcoin Price Bitcoin Cryptocurrency

Koinly Crypto Tax Calculator For Australia Nz

Koinly Crypto Tax Calculator For Australia Nz

Australia Calculate And File Bitcoin Cryptocurrency Taxes Coinpanda

Best Australian Tax Software For Crypto Taxes Koinly

Secp Orders Companies To Stop Dealing In Cryptocurrency Https Propakistani Pk 2020 09 03 Secp Orders Companies To Stop Bitcoin Cryptocurrency Online Trading

Send Money Abroad Instantly With Buyforexonline Com Money Transfer Send Money Instant Money

Pin By Keli Joie On Quick Saves In 2022 Option Trading How To Introduce Yourself Bitcoin Value

Cryptocurrency Taxes In Australia 2021 2022 Guide Cointracker