massachusetts estate tax rates table

The rates are set at 1522 per 1000 assessed valuation for residential properties and. Map of 2022 Massachusetts Property Tax Rates - Compare lowest and highest MA property taxes.

Oecd Tax Revenue Sources Of Revenue In The Oecd 2022

Compare your take home after tax and estimate.

. This tool is provided to help estimate potential estate taxes and should not be relied upon without the assistance of a qualified estate tax professional. What is the property tax rate in Worcester MA. This means if the value of an estate exceeds the 1 million threshold anything above 40000 will be taxed.

Print This Table Next Table starting at 4780 Price Tax. 22 rows The income rate is 500 and then the sales tax rate is 625. If the estate is worth less than 1000000 you dont need to file a return or.

104 of home value. 800 524-1620 Massachusetts State County City. Worcester sets tax rate for 2022.

If youre responsible for the estate of someone who died you may need to file an estate tax return. Map of 2022 Property Tax Rates in Hampshire County Massachusetts. 2016 Massachusetts Tax Tables with 2022 Federal income tax rates medicare rate FICA and supporting tax and withholdings calculator.

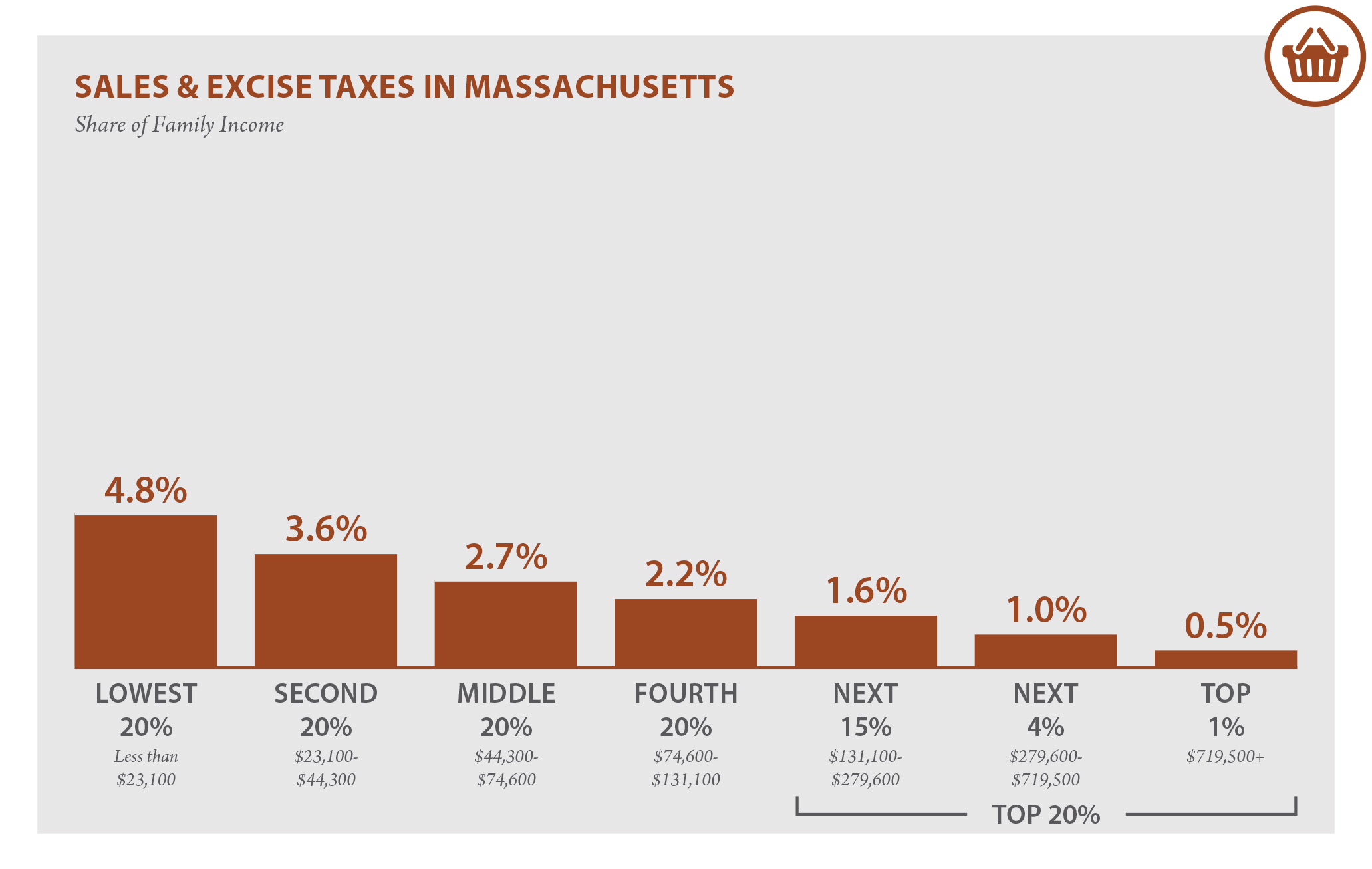

Sales rate is in the top-20. MA with the highest 2022 property tax rates are Amherst 2127 Pelham 2056 and Westhampton. When we add that.

Massachusetts uses a graduated tax rate which ranges between. 73 rows The formula to calculate Massachusetts Property Taxes is Assessed Value x Property Tax. Massachusetts Sales Tax Table at 625 - Prices from 100 to 4780.

It is assessed on estates valued at more than 1 million. The estate tax rate is based on the value of the decedents entire taxable estate. Tax amount varies by county.

Massachusetts does levy an estate tax. Additionally because the taxable estate of. A Massachusetts estate tax return Form M-706 is required to be filed because the decedents estate exceeds the filing threshold.

Unlike most estate taxes the. That amount multiplied by the marginal rate of 128 is 20480. Massachusetts State Single Filer Personal Income Tax Rates and Thresholds in 2022.

22 rows Massachusetts Estate Tax Rates. The bottom of the threshold is 6040 million so we subtract that from 62 million and get 160000. The median property tax in Massachusetts is 351100 per year for a home worth the median value of 33850000.

The rate for residential and commercial property is based on the dollar amount per. For your reference I provided the 2016 Massachusetts Property Tax Rates By Town in the table below. Up to 25 cash back If you were to translate the amount owed into a tax rate on the portion of the estate that exceeds the Massachusetts exemption amount of 1 million the top rate would.

The graduated tax rates are capped at 16.

How Is Tax Liability Calculated Common Tax Questions Answered

How Do State And Local Corporate Income Taxes Work Tax Policy Center

How Do State And Local Sales Taxes Work Tax Policy Center

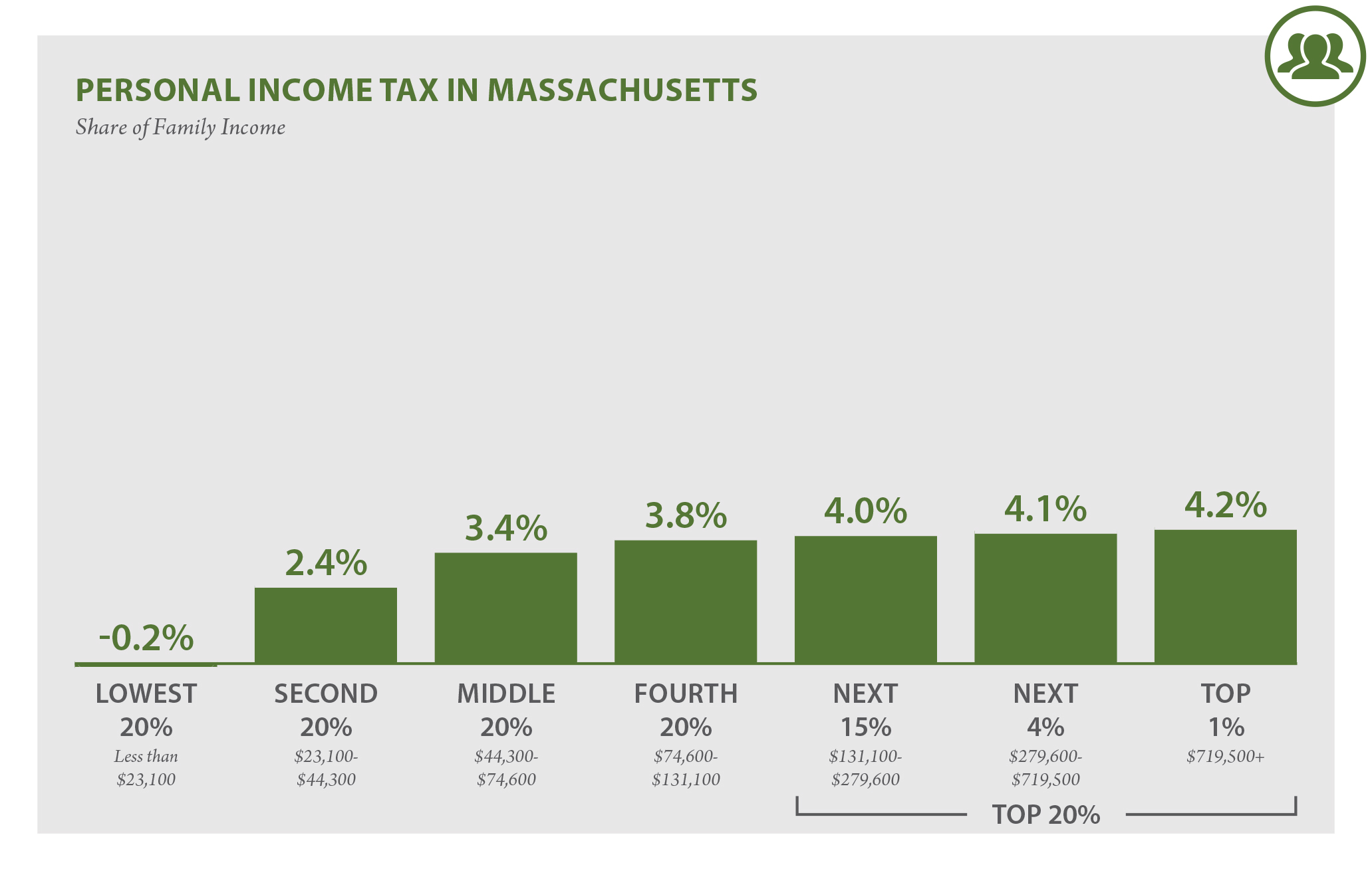

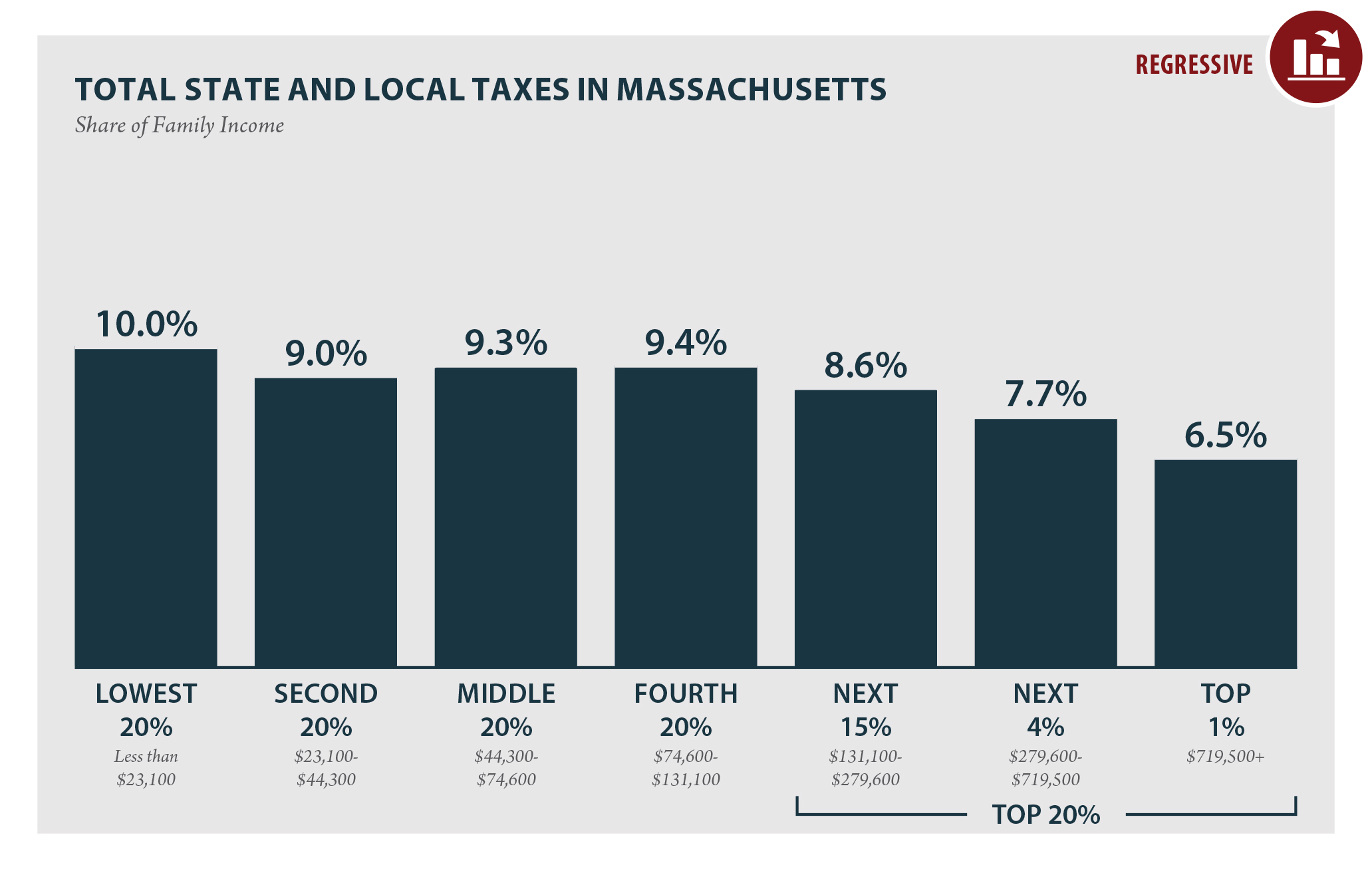

Massachusetts Who Pays 6th Edition Itep

2022 Tax Inflation Adjustments Released By Irs

How Do State Estate And Inheritance Taxes Work Tax Policy Center

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

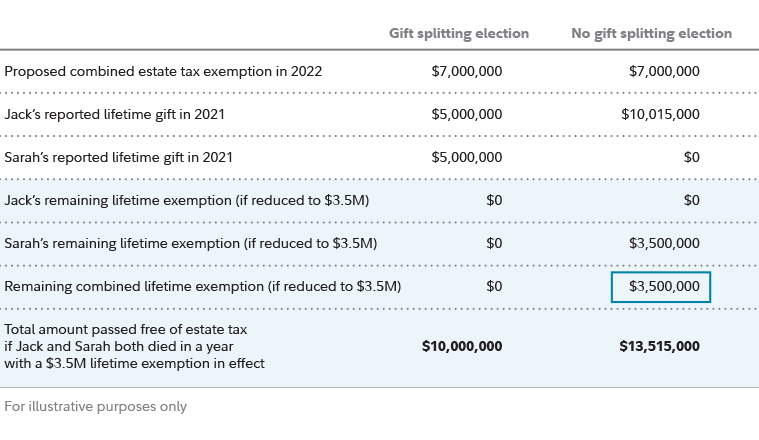

Estate Planning Strategies For Gift Splitting Fidelity

Massachusetts Who Pays 6th Edition Itep

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

How Do State And Local Corporate Income Taxes Work Tax Policy Center

Massachusetts Estate And Gift Taxes Explained Wealth Management

Breaking Down The Oregon Estate Tax Southwest Portland Law Group

Massachusetts Who Pays 6th Edition Itep

How Is Tax Liability Calculated Common Tax Questions Answered

The Economic Impact Of Tax Changes 1920 1939 Cato Institute

A Guide To Estate Taxes Mass Gov

Massachusetts Tax Forms 2021 Printable State Ma Form 1 And Ma Form 1 Instructions